Contents

- 1 Positive Outlook for the Industrial Services Industry

- 2 Understanding the Industrial Services Industry

- 3 Key Trends Shaping the Future of the Industry

- 4 Zacks Industry Rank Indicates Bright Prospects

- 5 Industry Performance Compared to S&P 500 and Sector

- 6 Current Valuation of the Industry

- 7 Top Industrial Services Stocks to Consider

Positive Outlook for the Industrial Services Industry

The near-term outlook for the industrial services industry appears promising, driven by increased e-commerce activity and a recent rise in the production index. Companies within this sector are focusing on strategic pricing, cost-reduction initiatives, and enhancing productivity and efficiency to improve margins. These efforts are expected to support sustainable growth and strengthen their market positions in the coming quarters.

Several companies are well-positioned to benefit from these trends, including Siemens (SIEGY), MSC Industrial Direct (MSM), and Eos Energy Enterprises (EOSE). These firms are actively cutting costs, improving operational efficiency, and investing in automation and digitization. Such moves are anticipated to drive long-term growth and enhance their competitive standing.

Understanding the Industrial Services Industry

The Zacks Industrial Services industry includes companies that provide industrial equipment products and MRO (maintenance, repair, and operations) services. These services encompass routine maintenance, emergency maintenance, and spare part inventory control, which help keep facilities and equipment in optimal operating condition. The industry serves a diverse range of customers, such as commercial, government, healthcare, and manufacturing sectors.

The products offered by these companies, including power tools, hand tools, cutting fluids, lubricants, personal protective equipment, and consumables, are used in production and plant maintenance but are not directly related to customers’ core products or services. By offering inventory management and process and procurement solutions, these companies help reduce MRO supply-chain costs and improve plant floor productivity.

Key Trends Shaping the Future of the Industry

E-Commerce as a Growth Driver

E-commerce is playing a significant role in driving demand for MRO services. Customers are increasingly seeking tailored solutions with real-time access to information and rapid product delivery. According to a Grand View Research report, global e-commerce revenues are projected to grow at a compound annual growth rate (CAGR) of 18.9% between 2024 and 2030. In the U.S., the e-commerce market is expected to see a CAGR of 16.4% during the same period.

To capitalize on this trend, industrial service companies are investing heavily in improving their digital capabilities and increasing their e-commerce presence.

Production Index Enters Expansion Territory

The manufacturing sector accounts for around 70% of the industry’s revenues. Although the Institute for Supply Management’s manufacturing index has been in contraction for the past five months, it registered 49% in June. This marked a slight increase from the 48.5% in May. Notably, the Production Index entered expansion territory for the first time in four months, registering 50.3%. This uptick is seen as a positive sign for the industry.

Pricing Actions to Combat High Costs

The industry is experiencing high inflation levels, with rising costs for labor, freight, and fuel. Labor shortages and the imposition of tariffs are also contributing to increased costs. To mitigate these challenges, industry players are implementing pricing actions, cost-cutting measures, and efforts to improve productivity and efficiency. Diversifying the supplier base is another strategy being pursued to manage these headwinds.

Zacks Industry Rank Indicates Bright Prospects

The Zacks Industry Rank, which reflects the average Zacks Rank of all member stocks, indicates encouraging prospects for the industrial services industry. The group currently holds a Zacks Industry Rank #60, placing it in the top 24% of 246 Zacks industries. Research shows that the top 50% of Zacks-ranked industries outperform the bottom 50% by more than 2 to 1.

Industry Performance Compared to S&P 500 and Sector

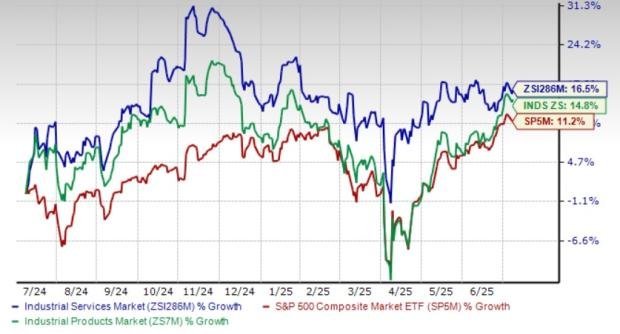

Over the past year, the Industrial Services industry has outperformed both its sector and the Zacks S&P 500 composite. The industry grew by 16.5%, compared to the sector’s 14.8% and the Zacks S&P 500 composite’s 11.2% growth.

Current Valuation of the Industry

Based on the forward 12-month EV/EBITDA ratio, the industry is currently trading at 30.7X, compared to the S&P 500’s 13.89X and the Industrial Products sector’s 19.94X. Over the last five years, the industry has traded as high as 37.03X and as low as 22.65X, with a median of 30.27X.

Top Industrial Services Stocks to Consider

Siemens (SIEGY)

Siemens witnessed a 10% increase in orders in the second quarter, with revenues up 7%. Revenue growth was observed in most industrial businesses, led by significant increases at Mobility and Smart Infrastructure. The company recently acquired Altair Engineering Inc. and Dotmatics, expanding its leadership in simulation and industrial AI. The Zacks Consensus Estimate for fiscal 2025 earnings has been revised upward by 2%, indicating year-over-year growth of 10.2%. SIEGY has a trailing four-quarter earnings surprise of 14.9% and a Zacks Rank #1 (Strong Buy).

Eos Energy Enterprises (EOSE)

Eos Energy Enterprises received a $22.7 million loan advance from the Department of Energy, allowing it to fully draw the maximum allowable amount under the first tranche of $90.9 million. The company expects revenue between $150 million and $190 million in 2025, driven by increased production volume. The Zacks Consensus Estimate for fiscal 2025 earnings is a loss of 52 cents per share, with a Zacks Rank #2 (Buy).

MSC Industrial (MSM)

MSC Industrial reported encouraging data points in its fiscal third quarter, including core customer sequential improvement and continued momentum in high-touch solutions. The company recently acquired ApTex, Inc. and Premier Tool Grinding, Inc., strengthening its position in key markets. The Zacks Consensus Estimate for 2025 earnings remains stable, with a Zacks Rank of 2.