Contents

Adobe’s Strong Financial Performance and Market Position

Adobe has demonstrated impressive financial performance in the second quarter of fiscal 2025, reporting an operating cash flow of $2.19 billion, which represents a 13% increase compared to the same period last year. Despite a sequential decline of 15%, the company’s bright prospects are fueled by its expanding AI portfolio, making it a key player in the evolving digital landscape.

Factors Driving Adobe’s Cash Flow Growth

Several factors contribute to Adobe’s growing cash flow. The company’s core Digital Media segment, led by Creative Cloud and Document Cloud, continues to deliver strong recurring revenues. These products benefit from subscription models that provide consistent income. Additionally, the increasing adoption of AI-driven features such as Firefly, Acrobat AI Assistant, and Express enhances customer engagement and product stickiness.

Adobe also benefits from a rising Remaining Performance Obligations (RPO) of $19.69 billion, with 67% expected to be recognized within the next year. This provides visibility into future cash inflows and highlights the company’s ability to sustain growth.

Maintaining Momentum and Strategic Investments

The question now is whether Adobe can maintain this momentum. With $5.71 billion in cash and short-term investments as of May 30, 2025, the company is well-positioned to continue investing in product innovation, AI integration, and strategic acquisitions. Its strong cash reserves offer flexibility to navigate economic headwinds while maintaining share repurchases. In the second quarter alone, Adobe repurchased 8.6 million shares, and it currently has $10.90 billion remaining under its $25 billion authorization.

For investors, these indicators reinforce confidence in Adobe’s ability to deliver long-term value. As the company evolves from a creative software leader to a broader digital experience and AI powerhouse, its financial strength is laying the foundation for enduring momentum.

Competitors Challenging Adobe’s Market Hold

Microsoft and Salesforce are significant competitors challenging Adobe’s market position. Microsoft competes through its robust cloud and productivity suites, particularly Azure and Microsoft 365 Copilot, which are integrated with creative tools and workflow automation. Unlike Adobe’s specialized product lineup, Microsoft’s scale across cloud and AI ecosystems offers seamless cross-platform selling opportunities. In the third quarter of fiscal 2025, Microsoft generated roughly $37 billion, up 16% year over year, driven by strong cloud billings and collections.

Salesforce directly challenges Adobe in the digital marketing and experience space with Salesforce Marketing Cloud, Service Cloud, and Gen AI-powered customer tools. While Adobe excels in creative workflows, Salesforce leads in CRM-based automation and enterprise reach. In the first quarter of fiscal 2026, Salesforce reported $6.5 billion in operating cash flow, up 4% year over year, underscoring the company’s strength in monetizing its platform and expanding its digital experience footprint.

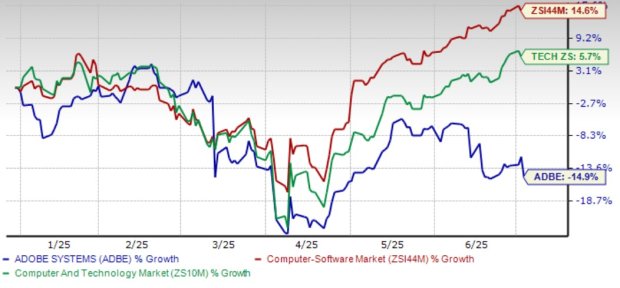

Adobe shares have declined 14.9% year to date, while the broader Zacks Computer and Technology sector has returned 5.7%, and the Computer-Software industry has risen 14.6%. The stock is trading at a premium, with a forward 12-month Price/Sales ratio of 6.7X compared to the Computer and Technology sector’s 6.51X. Adobe has a Value Score of C.

The Zacks Consensus Estimate for ADBE’s earnings is pegged at $20.61 per share for fiscal 2025 and $23.24 for fiscal 2026, indicating year-over-year growth of 11.89% and 12.76%, respectively. The consensus mark for earnings estimates for fiscal 2025 and 2026 has been revised upward by 1.2% and 1.5%, respectively, over the past 30 days.

Adobe currently carries a Zacks Rank #2 (Buy), reflecting positive expectations for its future performance. Investors looking for high-potential stocks can explore the complete list of today’s Zacks #1 Rank (Strong Buy) stocks.