Contents

Overview of GTLB’s Performance

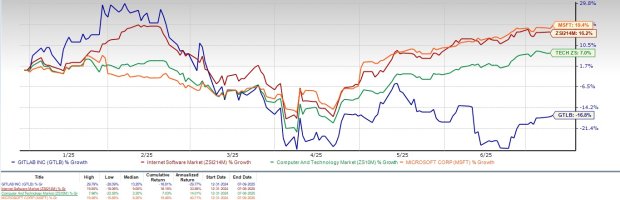

GTLB shares have experienced a decline of 16.8% year-to-date, which is significantly lower than the broader Zacks Computer & Technology sector that has seen a 7% increase and the Zacks Internet – Software industry that has grown by 16.2%. This underperformance can be attributed to several factors, including macroeconomic uncertainties and heightened competition in the AI-enabled DevSecOps space. Notably, larger players like Microsoft have made significant strides in this area by integrating GitHub and Azure DevOps seamlessly, further solidifying their market position. In comparison, Microsoft shares have gained 19.4% during the same period.

Strong Demand for GitLab’s DevSecOps Platform

Despite these challenges, GitLab continues to benefit from robust demand for its DevSecOps platform. Its suite of solutions, such as GitLab Ultimate, Dedicated, and GitLab Duo, plays a crucial role in driving customer adoption and maintaining strong relationships with existing clients. The company’s expanding client base and leadership in the DevSecOps platform category are key contributors to its growth prospects.

In the first quarter of fiscal 2026, the number of customers with more than $5K of Annual Recurring Revenue (ARR) increased to 10,104, representing a 13% year-over-year growth. Similarly, customers with more than $100K of ARR rose to 1,288, an impressive 26% increase from the previous year. These figures highlight GitLab’s ability to attract and retain large enterprise customers.

Expanding Portfolio and Innovations

GitLab has been actively expanding its portfolio, introducing new features and capabilities that enhance its offerings. In May 2025, GitLab launched GitLab 18, which introduced powerful AI-native features across its DevSecOps platform. This release includes integrated AI tools such as Code Suggestions and Chat, available at no additional cost to Premium and Ultimate customers.

Premium users can also access advanced AI features through the purchase of Duo Enterprise without upgrading to Ultimate. Additionally, GitLab 18 enhances CI/CD performance, artifact management, and security compliance with new tools like custom Static Application Security Testing logic, Fast Identity Online passkey support, and organization-level vulnerability dashboards.

Further strengthening its position, GitLab achieved FedRAMP Moderate Authority to Operate status for GitLab Dedicated for Government in May 2025, enhancing secure DevSecOps for federal agencies.

Strategic Partnerships and Collaborations

GitLab is leveraging its rich partner network to expand its footprint among large enterprise customers. Key partners include cloud platforms such as Alphabet’s Google Cloud and Amazon. These collaborations are helping GitLab enhance its offerings and improve developer productivity.

In April 2025, GitLab announced the general availability of GitLab Duo with Amazon Q, integrating Amazon Q’s AI agents into its DevSecOps platform. This integration aims to accelerate development, modernize legacy code, and streamline security and code reviews. Similarly, the integration of GitLab’s DevSecOps platform with Alphabet’s Google Cloud services is enhancing developer productivity by streamlining authentication, boosting application deployment, and improving the overall developer experience.

Financial Outlook and Guidance

For the second quarter of fiscal 2026, GitLab expects revenues between $226 million and $227 million, indicating a year-over-year growth of approximately 24%. Non-GAAP fiscal second-quarter earnings are projected to be between 16 cents and 17 cents per share.

Looking ahead, GitLab anticipates revenues for fiscal 2026 to range between $936 million and $942 million, reflecting a similar 24% year-over-year growth. Non-GAAP earnings are expected to be between 74 cents and 75 cents per share.

Earnings Estimates and Valuation

The Zacks Consensus Estimate for GTLB’s second-quarter fiscal 2026 earnings is currently set at 16 cents per share, showing a slight increase over the past 30 days. This indicates a year-over-year growth of 6.67%. The consensus revenue estimate for the same period is $226.55 million, representing a 24.08% year-over-year increase.

For fiscal 2026, the consensus mark for earnings is 75 cents per share, with a 7.14% increase over the past 30 days. This reflects a year-over-year growth of 1.35%. The revenue forecast for the year stands at $939.60 million, signaling a 23.75% year-over-year increase.

Current Valuation and Investment Considerations

Currently, GTLB stock is trading at a premium, with a Value Score of F suggesting a stretched valuation. The forward 12-month price/sales (P/S) ratio for GTLB is 7.57X, which is higher than the Zacks Computer and Technology sector average of 6.57X.

While GitLab’s strong growth, AI-powered DevSecOps platform, and solid partnerships position it as a leader in the DevOps space, investors should be aware of potential challenges. These include one-time expenses such as the global Summit event and ongoing costs related to its China joint venture, Jihu, which may impact margins. Macroeconomic uncertainties and increased competition in AI-enabled DevSecOps remain headwinds, and the stretched valuation could also be a concern.

GitLab currently holds a Zacks Rank #3 (Hold), suggesting that investors may want to wait for a more favorable entry point before considering an investment.