Contents

The Ripple Effects of Tariffs on US Prices

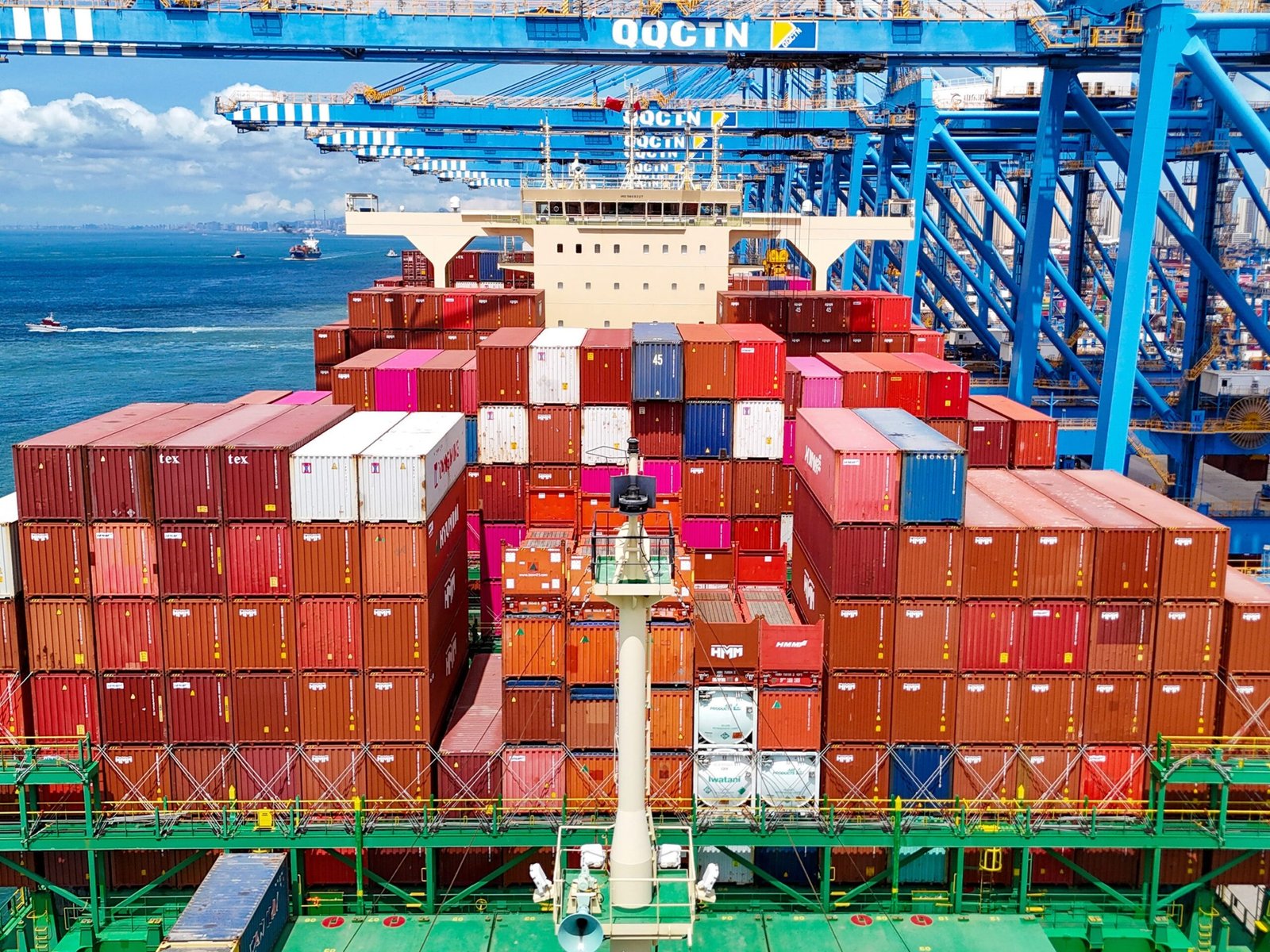

The recent implementation of tariffs by the United States has led to a noticeable rise in the prices of some domestically produced goods. According to data from the Harvard Business School Pricing Lab, these price increases are small but significant, particularly following the imposition of new trade restrictions.

Understanding the Impact of Tariffs

Tariffs are not always directly visible on a customer’s receipt, yet they have a tangible effect on consumers. The average US tariff rate on imports has surged significantly compared to previous years, with the US Treasury estimating that it could collect $300 billion in tariff revenue for the full year.

These tariffs are affecting the cost of imported goods, and in some cases, the prices of domestic products have also increased. Researchers from the HBS Pricing Lab analyzed over 330,000 product listings from four major US retailers and found that both imported goods and competing domestic products experienced price hikes after the initial wave of tariffs in early March.

Price Increases and Market Dynamics

The study revealed that prices for imported goods rose by approximately 3% between the start of the tariffs and the end of June. Simultaneously, categories of domestic goods that typically compete with imports saw around a 2% increase in prices. However, domestic goods that do not face significant competition from imports, such as most food and beverage items, did not experience similar price increases.

Although goods from China saw the largest price increases in the study, these increases were much lower than the tariff rates, which fluctuated between 10% and 145% during the period.

Uncertainty and Strategic Adjustments

The timing of these price increases suggests that companies are uncertain about how the tariffs will unfold, especially given recent changes in policy. One possible explanation for the broader price increases is that retailers are spreading the cost of tariffs across a range of products rather than just raising prices on imported goods.

Several factors contribute to the impact of tariffs on domestic goods. Many domestically produced items still rely on imported components that may be subject to tariffs, increasing production costs. Additionally, aspects of the supply chain, such as shipping and storage, can become more expensive as importers adjust their operations in response to new tariff rates.

Market Opportunities and Consumer Behavior

Domestic brands that typically compete with imports may also see an opportunity to raise prices as consumer expectations shift. Jonathan Pingle, chief US economist at UBS, noted that if importers face higher costs, domestic competitors might also raise their prices, even if not as drastically. This could allow them to maintain or even gain market share.

Pingle explained that this could lead to price increases in the economy that go beyond what the direct pass-through of tariffs would suggest. For example, if imported deck chairs see a price hike due to tariffs, US producers might also find an opportunity to charge more.

Broader Economic Implications

The overall impact of tariffs extends beyond just the direct costs. Companies across various sectors are grappling with managing both direct and indirect costs associated with these trade restrictions. Pingle emphasized that business costs are likely to rise, leading to potential second-round effects in the short term.

As the economic landscape continues to evolve, the effects of these tariffs will likely be felt across multiple industries and consumer segments. Understanding these dynamics is essential for businesses and consumers alike as they navigate the changing trade environment.