Contents

Strong Start to 2025 for OptimizeRx

OptimizeRx (OPRX) began 2025 with impressive momentum, reporting a 11% year-over-year increase in revenue to $21.9 million. The company also achieved $1.5 million in adjusted EBITDA, marking its strongest first-quarter performance to date. This success was driven by the company’s focus on cost management and strategic client engagement, which helped reduce the net loss and improve operating cash flow to $3.9 million. These financial improvements have supported a cash balance of $16.6 million, providing a solid foundation for future growth.

In response to this strong start, OptimizeRx has raised its full-year revenue guidance to a range of $101 to $106 million. The company also expects adjusted EBITDA to fall between $13 and $15 million, citing a robust pipeline of opportunities. A significant portion of the projected revenue—over 80%—is expected to come from existing contracts. Another key development is the company’s shift toward a subscription-based revenue model, which has already seen early adoption exceeding 5% of projected revenues. This model, combined with a scalable technology platform, is designed to create more stable revenue streams, improve margins, and strengthen client retention.

Despite these positive developments, gross margins for the quarter came in slightly lower at 60.9%, compared to 62% in the previous year. This decline was attributed to a higher proportion of lower-margin direct-to-consumer (DTC) managed services. While management remains focused on improving margins over time, the current mix may lead to near-term challenges depending on how quickly clients adopt higher-margin solutions.

The pharmaceutical industry is increasingly focused on efficiency and return on investment (ROI) in marketing budgets, influenced by regulatory changes and evolving channel strategies. OptimizeRx’s omnichannel platform, which integrates point-of-care data and targets real-world patients, aligns well with these priorities. Early results show a 25% increase in prescriptions and a 10:1 ROI, highlighting the value of the company’s offerings.

OptimizeRx is navigating macroeconomic uncertainties with agility, benefiting from a growing base of committed revenues, cost efficiencies, and a shift toward subscription models. Sustaining profit growth will depend on continued execution in monetizing data and strengthening customer relationships as pharma spending adapts to a more digital landscape.

Peer Performance Highlights

Veeva Systems

Veeva Systems (VEEV) reported strong first-quarter fiscal 2026 results, with revenue reaching $759 million—a 16.7% increase year-over-year. This growth was fueled by strong adoption of Vault CRM and Crossix. Despite broader economic uncertainty, management remains optimistic, emphasizing resilient subscription revenues and an expanding product pipeline. Crossix, which provides short-cycle ROI for pharma marketing, is experiencing over 30% year-over-year growth and is seen as less vulnerable to budget constraints. Veeva is also advancing Veeva AI to enhance customer value and boost commercial productivity, positioning itself as a key partner for pharma clients focused on efficiency and measurable outcomes.

Health Catalyst

Health Catalyst (HCAT) delivered $79.4 million in first-quarter 2025 revenue, a 6.3% increase from the previous year. Its tech platform, Ignite, drove 10% growth. In a climate of shifting funding in pharma and healthcare, HCAT’s modular and lower-cost Ignite platform enables faster ROI and shorter sales cycles, making it appealing in tight budget environments. The company is seeing strong client adoption, particularly among existing app users, and expects to add 40 net new Ignite clients in 2025. While some booking delays occurred due to Medicaid and research funding uncertainty, HCAT believes the long-term value and pricing flexibility of Ignite will support continued growth. Full-year guidance was maintained, reflecting confidence in the company’s ability to convert its pipeline into revenue.

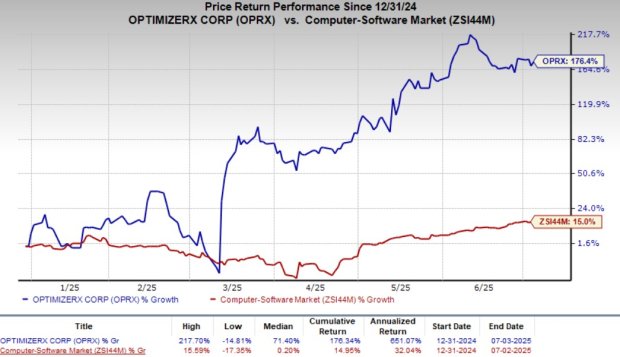

OPRX’s Price Performance, Valuation and Estimates

Shares of OptimizeRx have surged 176.4% year to date, outperforming the industry’s 15% growth. The company’s forward 12-month price-to-sales ratio of 2.25X is below the industry average of 8.67X and also lower than its five-year median of 3.63X. However, it carries a Value Score of F. The Zacks Consensus Estimate for OPRX’s 2025 earnings per share suggests a 63.6% improvement from 2024. OPRX stock currently holds a Zacks Rank #1 (Strong Buy), indicating strong investor confidence.